BizBuySell.com says second quarter 2016 Insight Report shows the small business sales market stabilizing at high activity levels; median time a business is on the market is about six months.

BizBuySell.com says second quarter 2016 Insight Report shows the small business sales market stabilizing at high activity levels; median time a business is on the market is about six months.

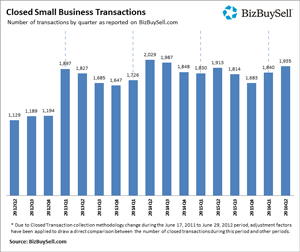

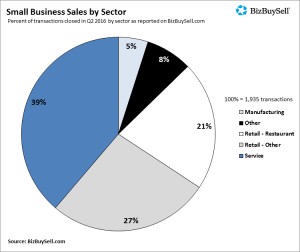

A total of 1,935 business sales closed during the second quarter of 2016, bringing the year-to-date total to 3.775, slightly higher than the 3,743 sales closed during the first half of 2015. 2016 is also on track to surpass sales in 2014, when a record 3,755 sales were closed during the first six months of that year.

The median revenues of sold businesses in the second quarter of 2016 averaged $441,331, a 2 percent drop from the same period in 2015; while the median cash flow grew by 2 percent to $105,000 during the second quarter of 2016. Sale prices remained similar from 2015 to 2016 – with 2015’s average sale price was $200,000 to 2016’s average sale price of $199,000.

“The fact that small business financials have remained stable and transactions continue to grow speaks to the strong number of buyers and sellers entering today’s market,” said Bob House, President of BizBuySell.com. He added that there is still a strong supply of purchase opportunities, driven by retiring Baby Boomers and qualified buyers with access to cheap capital.

Most businesses take approximately 6 months to sell in today’s market once listed. That is in addition to business brokers suggesting to sellers to take up to 6 months to prepare their business for listing. This time is spent on preparing 2 to 3 years of financials, optimizing operational efficiencies and improving the appearance of the business. These processes allow a seller to achieve the highest possible return on their sale.

“The timing of a small business sale is an especially tricky topic as there are certainly variables that can slow or speed the process,” House said. “Using this data as a benchmark, sellers should expect it to take about 1 year from the initial decision to sell to the point where they actually find a buyer for their business.”

But as time on the market increases, it does bode well for asking prices. After 10 straight quarters of

But as time on the market increases, it does bode well for asking prices. After 10 straight quarters of

faster sales cycles, the time to sell started increasing in the

fourth quarter of 2014, just after the median asking prices began to increase. To note, since sitting at $200,000 in the third quarter of 2014, the median asking price of sold businesses gradually increased to an average high point of $249,500 in the last quarter.

As we move closer to the 2016 Presidential election, it will no doubt be at the top of mind for small business owner’s. The newly elected President’s small policies will shape the future of SMB regulations and could cause a shift in the number of owners looking to sell or buy.

“While we’ve seen few significant fluctuations in the business-for-sale market over the past few years, the election could certainly change that,” House added. “Many people could be motivated to either enter or exit business ownership based on their view of the winner’s future policies. It is something we will be watching closing in our second half insight reports.”

Sunbelt Business Brokers-Midwest uses BizBuySell.com as one of its many marketing outlets for your business sale.