Source: Business Broker Industry Research | Download the Market Pulse Report

The quarterly IBBA and M&A Source Market Pulse Survey was created to gain an accurate understanding of the market conditions for businesses being sold in Main Street and the Lower Middle Market. The national survey was conducted with the intent of providing a valuable resource to business owners and their advisors.

Here are the highlights from the Q2 2025 Survey:

Market Conditions & Confidence

Tariffs:

Minimal impact—over 75% of advisors report tariffs are not delaying deals. Other factors (interest rates, performance, personal timing) weigh more heavily.

Direct Buyer Outreach:

Growing trend, especially in the Lower Middle Market. Nearly 30% of advisors report clients being approached by private equity groups or strategic buyers.

Seller Confidence:

Improving, particularly in $1M–$2M businesses (57% view it as a seller’s market). Larger transactions continue to attract stronger optimism than Main Street deals.

Business Valuation Trends

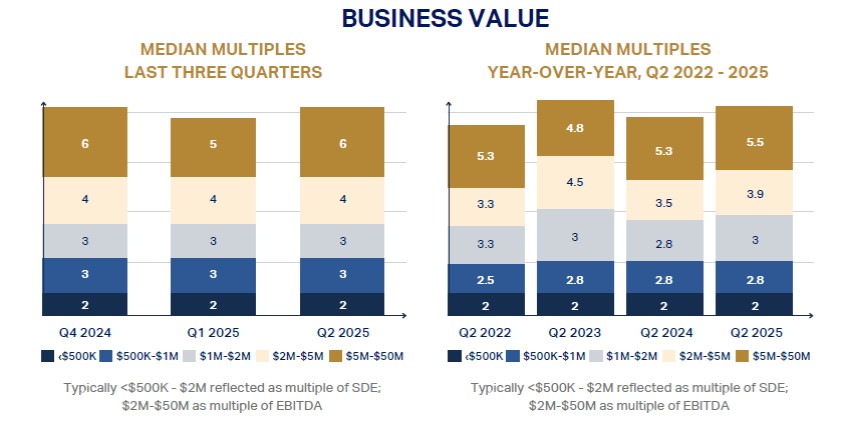

Deal Multiples:

Overall stable. Sub-$500K deals ticked up to 2.3x, while $5M–$50M rebounded to 5.5x after a dip in Q1.

$2M–$5M Sector:

Continues to see sub-4.0 multiples for the fifth consecutive quarter, reflecting buyers’ recalibration of risk.

Offers Per Deal:

Sellers continue to see multiple bids (2–4 offers on average), supporting competitive dealmaking.

Deal Structures & Financing

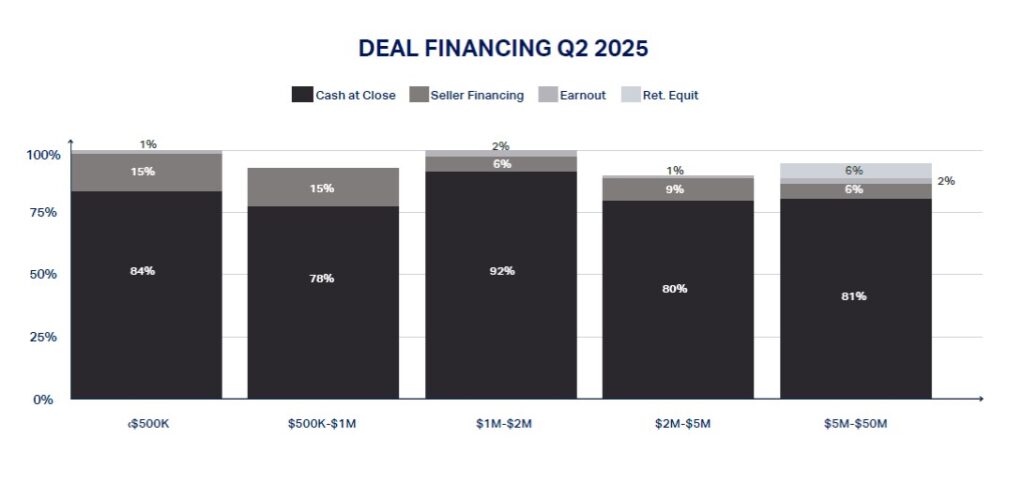

Cash Dominates:

Sellers are receiving 78–92% cash at close, with limited reliance on earnouts or retained equity. Seller financing remains more common in smaller deals.

Time to Close:

Back to normal—most transactions are closing in 6–9 months from engagement.

Buyer & Industry Trends

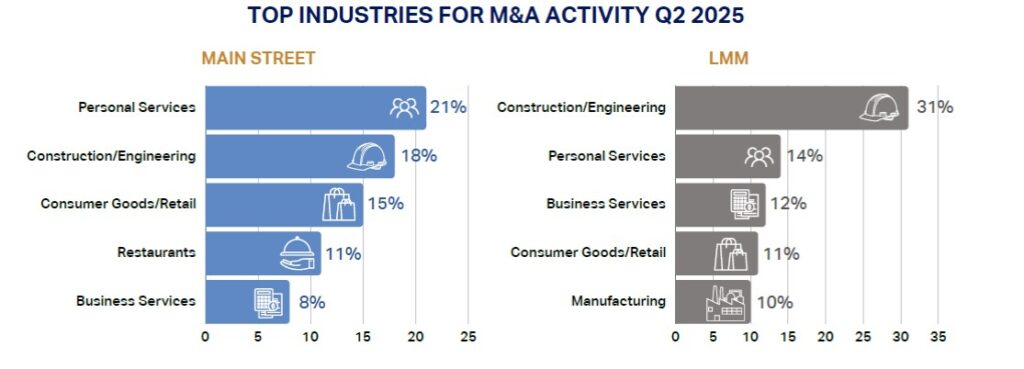

Top Industries:

Construction/engineering leads across all deal sizes, followed by personal services, business services, and consumer goods.

Buyer Profiles:

Main Street: More first-time buyers motivated by job acquisition. Lower Middle Market: Strategic buyers and private equity more prominent. Serial entrepreneurs are on the rise, signaling repeat ownership trends.

Takeaway

The market is steady, with solid buyer demand, strong cash at close, and stable multiples. Sellers are best positioned when they have representation and can create competitive bidding, especially as unsolicited offers continue to increase.