KAG Cements presence in Canada with acquisition.

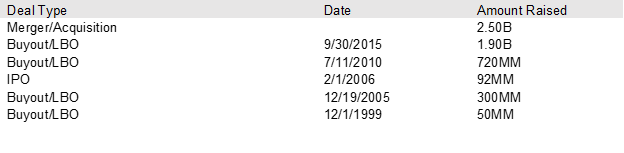

Mid-October 2020, American trucking and logistics company agrees to acquire an ally from the North. Kenan Advantage Group, from North Canton, Ohio has acquired Paul’s Hauling Ltd., from Winnipeg, Manitoba. Kegan Advantage Group is among the top trucking and logistics companies in the United States, while Paul’s Hauling Ltd. provides a strong presence in trucking through western Canada. KAG’s Canada branch will gain 233 tractors, 353 trailers, and over 300 new employees (drivers and operations personnel). This transaction serves to cement KAG’s presence in Canada. Below is Kenan Advantage Group’s timeline and deal history, starting from the $50 million buyout in 1999 to the announced acquisition of Paul’s Hauling Ltd. through an acquisition. Kenan Advantage group also acquired Canadian trucking and distributing company Les Distributions Carl Beaulac Inc. on September 18, 2020.

Precedent Comparable Transactions: Trucking Industry

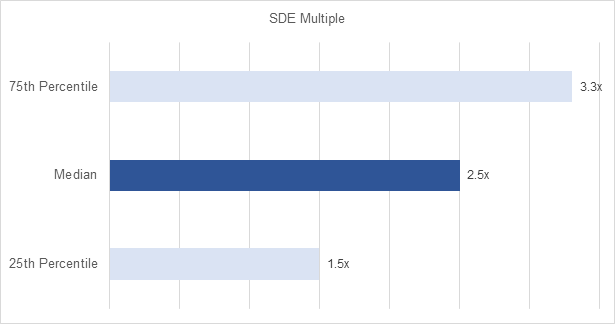

Main Street companies (below $5,000,000 in revenue) in the Trucking industry (SIC 4210, 4212, 4213, 4214) had a SDE1 Median Multiple of 2.5x, based on 75 transactions between 2015 and 2020.

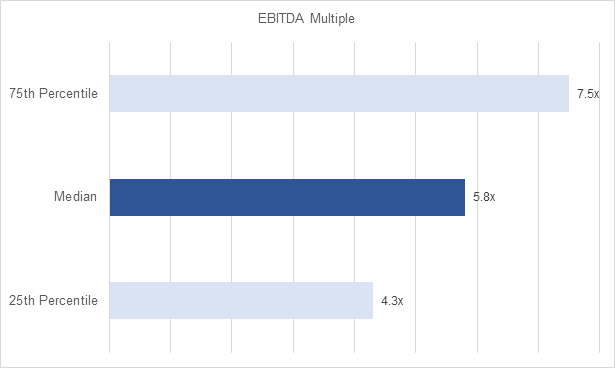

Middle Market companies (above $5,000,000 in revenue) in the Trucking industry (SIC 4210, 4212, 4213, 4214) had an EBITDA2 Median Multiple of 5.8x, based on 19 transactions between 2015 and 2020.

If you’re contemplating a sale of your trucking company or simply would like to understand your options, contact a Sunbelt Trucking Industry Expert today. We have closed multiple strategic and financial transactions in the trucking industry and have industry specialists ready to answer any of your questions.

1Seller’s Discretionary Earnings – Seller’s discretionary earnings is defined as net profit before taxes and any compensation to owner plus amortization, depreciation, interest, other non-cash expense and non-business-related expense and normally to one working owner. (Source: BV Market Data)

2Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) – EBITDA is Net Income with interest, taxes, depreciation, and amortization added back to it. EBITDA can be used to analyze and compare profitability between companies and industries because it eliminates the effects of financing and accounting decisions. However, this is a non-GAAP measure that allows a greater amount of discretion as to what is (and is not) included in the calculation. This also means that companies often change the items included in their EBITDA calculation from one reporting period to the next. (Source: BV Market Data)